Ideas

Jan 2026

Type

IdeasShare

Twitter Facebook LinkedInArticle by

Domenic Cerantonio

But you probably know that already—it’s been on the rise since the early 2010s, when creative agencies and design studios started migrating eastwards-and-down-a-bit from the CBD in search of cheaper rents and a healthy dose of urban grit.

A lot has happened since then. Driven by ever-increasing market demand and fuelled by government support—at both the State and LGA levels—Richmond and Cremorne have grown from a waning industrial precinct into what some have dubbed the Silicon Valley of Melbourne.

In particular, the past five years have seen Richmond and Cremorne spring to life. An influx of high-profile tenants—Seek, MYOB, and Domain, to name just a few—and a flurry of architecturally significant commercial developments have cemented 3121 as a highly coveted locale for life, work, and play.

Cremorne alone is less than one square kilometre in size, yet is home to over 700 businesses, accommodating more than 10,000 workers each day. And the demand for more is still strong. Upon practical completion of Sixty-Five Dover in May 2024, developer Fortis had already leased 90% of its 9,324-sqm commercial NLA. The occupancy rate hit 100% soon after, with high-profile tenants including Baker Bleu, Suupaa by Future Future, Adidas, and two full floors allocated to co-working giant The Commons’ luxury offshoot, Forum.

Just across the tracks, Beams Projects set a new pricing benchmark in 2021 when it sold its newly completed seven-storey brutalist office building to a Hong Kong–based investor for $19.5 million. Sitting on a tight 368-sqm land parcel, the property sold on a 3.7% yield, translating to a building rate of $13,829 per sqm and a land rate of $53,100 per sqm. The case studies are plentiful—I’ll let you dig those up. What’s more interesting is what lies ahead.

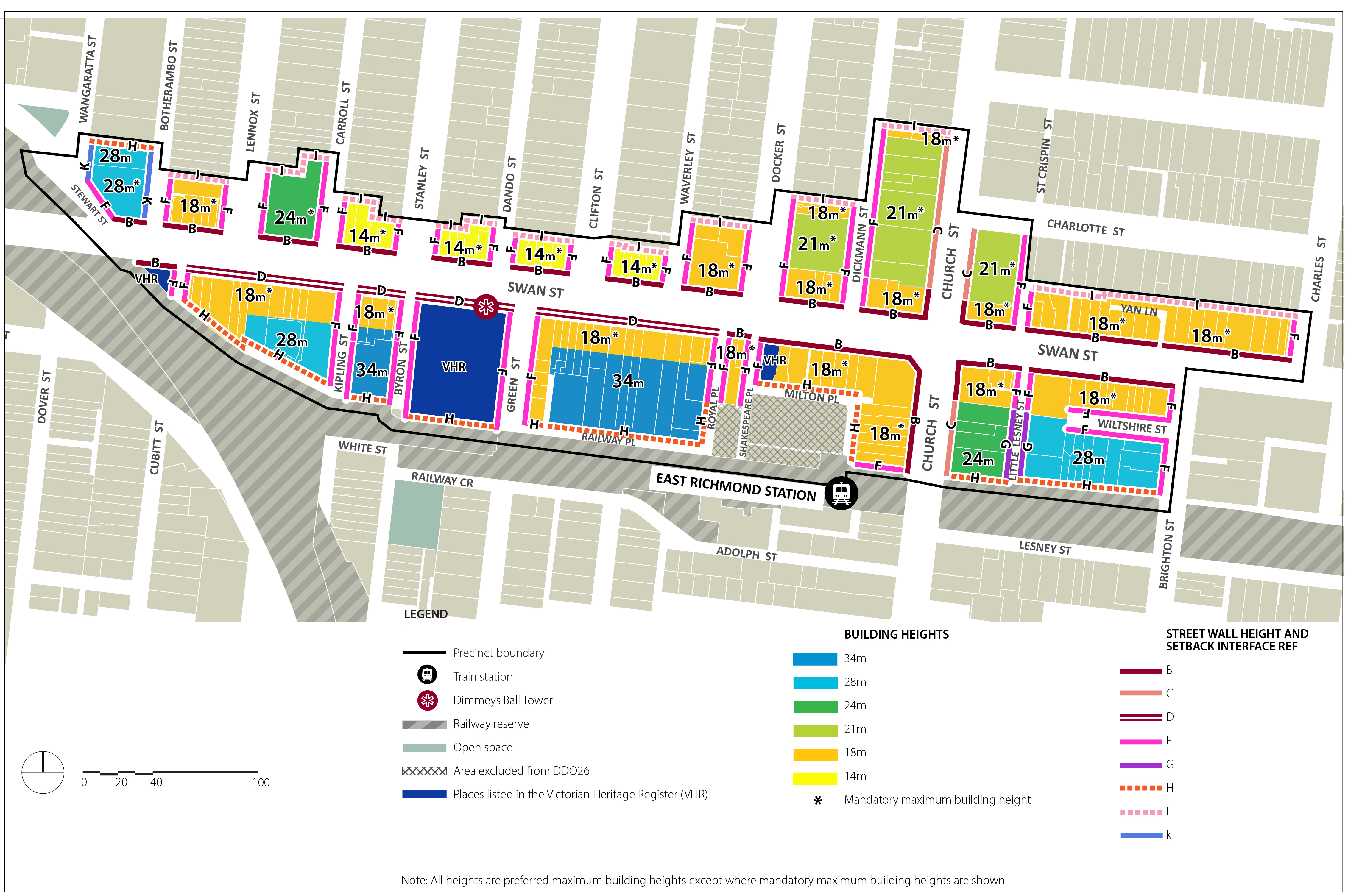

While Cremorne has seen significant development in recent years—encouraged by both the Victorian Planning Authority (VPA) and City of Yarra—the Swan Street corridor remains relatively underdeveloped. That’s despite the flexible planning controls introduced to the Yarra Planning Scheme in 2022, which encourage growth without imposing overly prescriptive restrictions. These controls suggest preferred building heights and setbacks but leave room for interpretation, especially outside of heritage overlays. So far, only a handful of projects have taken advantage—AusPost HQ in Burnley, completed in 2023, is a notable exception.

That leaves a substantial opportunity for mixed-use development along Swan Street—particularly towards the eastern edge of Richmond and Burnley. This corridor is perfectly positioned to support the next wave of growth: a mix of commercial, residential, and hospitality offerings that enhance the area’s amenity and reinforce its role as a key activity centre. Developments here could benefit from excellent transport links, proximity to parklands, and a well-established business ecosystem.

What’s more, the VPA’s Development Facilitation Program offers an expedited planning process for eligible projects that inject investment into the Victorian economy, generate employment, or deliver much-needed housing. Projects over 10,000 sqm in office NLA are able to access the State Government’s Development Facilitation Unit, bypassing some of Council’s processes and avoiding third-party appeal rights. Projects that increase housing diversity and density, offer easy access to transport and amenities, and demonstrate design excellence and sustainability credentials may also qualify for fast-tracking.

If you’re not already considering this program, you should be. It’s a powerful tool for developers looking to get shovels in the ground sooner—and in a market as competitive and dynamic as 3121, time is money.

Looking ahead, population growth will only increase demand. Projections indicate that by 2031–32, Melbourne will become Australia’s largest city, overtaking Sydney. It’s no surprise then that the State Government has included Richmond as a Suburban Rail Loop Housing Precinct—an initiative to increase housing density around key activity centres. While we won’t know the full extent of these planning changes until consultation opens later this year, it’s unlikely we’ll see mandatory controls. More likely, we’ll see “deemed-to-comply” heights and setbacks designed to guide rather than restrict development.

Beyond the commercial and residential appeal, there’s a pressing need—and opportunity—to deliver more high-quality retail and food and beverage assets, particularly along the Swan Street corridor. As new offices and apartment buildings bring more workers and residents into the area, the demand for hospitality venues, specialty grocers, wellness providers, and convenience retail will rise accordingly. Developers that embed these offerings into their ground-floor plans will not only add value to their projects—they’ll help shape the next chapter of Richmond’s evolution.

If you found this insightful and would like to talk to us about our Development Advisory services, get in touch.